Contents

- Short Call

- Best Online Brokers for Day Trading

- Sign Up & We’ll Send You 2 Free Trading Strategies

- Learn trading tips & strategiesfrom Ally Invest’s experts

- Top 3 Brokers Suited To Strategy Based Trading

- Atlanta’s Fintech Scene: A Haven for Practical Innovation and a Growing Hub for Talent and Investment

As its name indicates, day trading refers to a strategy in which a trader opens and closes positions in a particular trading vehicle during the day but generally doesn’t hold any positions overnight. Advanced trading strategies usually involve multiple technical indicators and more complicated instruments, such as options and futures. Portfolio Construction – Portfolio construction and risk management go hand-in-hand with more advanced approaches. Profitability – With advanced domain knowledge it is possible to estimate transaction costs reasonably well.

- Whether you’re after automated day trading strategies, or beginner and advanced tactics, you’ll need to take into account three essential components; volatility, liquidity and volume.

- Sometimes you may gain some pips per trade, but then still lose the funds.

- For example, some countries may be distrusting of the news, so the market may not react in the same way as you’d expect them to back home.

- You will also need to be disciplined enough to stick to your trading plan and good enough at market analysis and research to improve your odds of success when you do take a position.

- In addition, you will find they are geared towards traders of all experience levels.

Time management – Ensure any time allocated to trading is used efficiently. We’ll discuss one of the most versatile ML model familes, namely the Decision Tree, Random Forest and Boosted Tree models, and how we can apply them to predict asset returns. You may have spent a lot of money purchasing some sophisticated backtesting tools in the past and ultimately found them hard to use and not relevant to your style of quant trading. No doubt you’ve noticed the oversaturation of beginner Python tutorials and stats/machine learning references available on the internet. Learn how to trade from expert trader John Carter and learn his system that allows you to identify twice as many high probability trades.

Short Call

It’s particularly popular in the forex market, and it looks to capitalise on minute price changes. This is a fast-paced and exciting way to trade, but it can be risky. You need a high trading probability to even out the low risk vs reward ratio. However, you’ve grown beyond simple strategies and want to start trading your way to financial freedom improving your profitability and introducing some robust, professional risk management techniques to your portfolio. Another key way to prepare yourself for day trading consists of obtaining the knowledge about the fundamental market moving factors that drive the financial markets you intend to trade.

In addition to traditional exchanges, algorithmic trading also takes place in dark pools, which are private exchanges that allow for anonymous trading. In dark pools, trades are executed away from the public markets and are not visible to other traders. This anonymity can be achieved through encryption, which protects the identity and intentions of traders. Understanding the mechanics of dark pools and how to navigate them is becoming increasingly important as more trading takes place in these private exchanges. Day trading strategies for stocks rely on many of the same principles outlined throughout this page, and you can use many of the strategies outlined above. Below though is a specific strategy you can apply to the stock market.

Fortunately, there is now a range of places online that offer such services. You can find courses on day trading strategies for commodities, where you could be walked through a crude oil strategy. Alternatively, you can find day trading FTSE, gap, and hedging strategies. 80% of retail investor accounts lose money when trading CFDs with this provider.

Best Online Brokers for Day Trading

We will look at a linear time series technique based on the ARIMA+GARCH model on a range of equity stock indexes and see how the strategy performance changes over time. We will continue our risk management discussion from previous books and look at regime detection and stochastic volatility as a means of determining our current risk level and portfolio allocation. We’ll look at stochastic volatility models under a Bayesian framework, using these to identify periods of large market volatility for risk management. You’ll receive a complete beginner’s guide to time series analysis, including asset returns characteristics, serial correlation, the white noise and random walk models.

This means that by actually holding a position you are profiting too. There is even another advanced Forex trading strategy known as ‘carry trading’, which is based on earning through rollovers. It’s an impressive and innovative Forex strategy, but it does require a detailed analysis of the market before a trade is offered. This type of currency trading sits well with day traders who are risk averse.

Sign Up & We’ll Send You 2 Free Trading Strategies

You will want to select a broker suitable for your particular needs and preferences. Another investor may have a relatively smaller capital base and be interested cryptocurrency brokerage firm solely in increasing total wealth. Volatility of the overall P&L equity curve may not be as much of a concern if larger returns can be achieved.

Day trading strategies for the Indian market may not be as effective when you apply them in Australia. For example, some countries may be distrusting of the news, so the market may not react in the same way as you’d expect them to back home. Forex strategies are risky by nature as you need to accumulate your profits in a short space of time. You can apply any of the strategies above to the forex market, or you can see our forex page for detailed strategy examples. It’s also worth noting, this is one of the systems & methods that can be applied to indexes too.

In addition, even if you opt for early entry or end of day trading strategies, controlling your risk is essential if you want to still have cash in the bank at the end of the week. Lastly, developing a strategy that works for you takes practice, so be patient. In conclusion, there are many advanced trading strategies that experienced traders can use to improve their trading results.

Learn trading tips & strategiesfrom Ally Invest’s experts

Whether you are a trend follower, a breakout trader, or a position trader, there is a strategy that can help you achieve your trading goals. By incorporating these strategies into your trading plan, you can stay ahead of the game and achieve the success you desire. Data – Generally, data costs scale with frequency of the sampling, breadth of the universe, length of history, data quality and specificity of the asset class/instrument. More advanced strategies rely on niche markets to generate alpha. Such costs must be accounted for in order for a strategy to generate a profit.

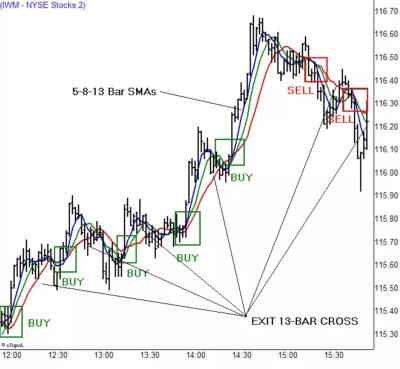

This strategy involves using two moving averages, a short-term and a long-term, and buying or selling when the short-term moving average crosses above or below the long-term moving average. How to implement advanced trading strategies using time series analysis, machine learning and Bayesian statistics with R and Python. Simpler strategies usually make use of readily available price/volume data on well-traded instruments in developed asset classes.

For more information on stocks strategies, see our Stocks and shares page. General news regarding cryptocurrencies or even blockchain technology can transform the entire market, so stay alert. Many coins, and even stablecoins, are inter-linked – which can cause massive contagion if there is a panic – even if it only starts in one obscure coin. You use the prices of the previous day’s high and low, plus the closing price of a security to calculate the pivot point. The ‘daily pivot’ strategy is considered a unique case of reverse trading, as it centres on buying and selling the daily low and high pullbacks/reverse.

For example, day traders using this indicator might enter into a trade when the price moves outside the cloud to suggest a new trend. That trade can be held until the trading day ends to take profits or until the Kijun Sen line is crossed to take a loss. Traders might therefore use a trailing stop loss that follows price action and is situated on the opposite side of the Kijun Sen line.

Yewno|Edge is the answer to information overload for investment research. This powerful AI-driven platform is the only one of its kind that transforms massive amounts of fundamental and alternative data into actionable investment insights. Benzinga is compensated if you access certain of the products or services offered by eToro USA LLC and/or eToro USA Securities Inc. Any testimonials contained in this communication may not be representative of the experience of other eToro customers and such testimonials are not guarantees of future performance or success. Traders often have differing priorities when selecting a broker depending on their level of experience and trading activity level.

Top 3 Brokers Suited To Strategy Based Trading

You’ll see 2 of its 5 lines form the “cloud” or Senkou Span, while its Kijun Sen line gives trading signals and a suitable stop loss region. As an example of a market opening gap strategy, you might observe the pre-market high point and then place a limit order to buy at that point if a retracement occurs. Another option might involve looking at the opening range for the first minute of trading. You can then enter and order to buy at the high of the market’s 1st 1-minute candle, while simultaneously putting your stop loss order at that candle’s low point. How to find new trading strategy ideas and objectively assess them for your portfolio using a Python-based backtesting engine. Infrastructure – Even if a robust backtesting framework has been built to research more advanced strategies an equally sophisticated infrastructure is required to trade it.

Simple Trading Strategies

We will initially use the familiar technique of linear regression, in both a Bayesian and classical sense, as a means of teaching more advanced machine learning concepts. Typically, in order to be successful in day trading, you need to have a lot of knowledge, experience, and skills. Check out Benzinga’s guides to the best day trading software, the best day trading brokers and day trading rules. In general, technical analysts believe that most smaller opening gaps are filled, while larger breakaway gaps tend to indicate the market will continue in that direction.

In this article we will discuss whether retail quants should invest the time to carry out these advanced strategies or instead stick with the simpler ideas. An age-old question in the quant community asks whether systematic traders should stick with simple quant money honey book strategies or expend the effort to implement more advanced approaches. Usually, the more advanced Forex trading skills you have, the larger your capital and the larger your volumes are. Scalping is a widely used technique among seasoned Forex traders.

Atlanta’s Fintech Scene: A Haven for Practical Innovation and a Growing Hub for Talent and Investment

This strategy involves using the RSI indicator to identify overbought and oversold conditions in the market. When the RSI is above 70, the market is considered overbought and when it is below 30, the market is considered oversold. This can help traders identify potential reversal points in the market. More importantly, we apply these libraries directly to real world quant trading problems such as alpha generation and portfolio risk management.

Transaction Costs – Due to the use of simple instruments in developed, liquid markets it is relatively easy to estimate transaction costs. This in turn makes it more straightforward to determine if a strategy is likely to be profitable out-of-sample. You may have heard the term swing trading being used amongst traders, but do you know what it is? Positional trading is something completely different from day trading – and it’s especially different from scalping. When a trader starts trading positions, they are expected to hold a position for quite a long period of time. It is hard to identify the minimum recommended holding time as it mainly depends on the trader’s overview of the market, and the amount of pips gained.

As an experienced trader, you are always looking for ways to stay ahead of the game and improve your trading results. One of the best ways to do this is to incorporate advanced trading strategies into your trading plan. In this article, we will discuss some of the most effective advanced trading strategies for experienced traders using Tradestation.